The Community emission trading scheme

On 11 December 1997, the world's most industrialised countries adopted the Kyoto Protocol as part of the United Nations Framework Convention on Climate Change (UNFCCC). The treaty assumed the commitment of the parties to the convention that were most intensive in CO2 (Annex I countries of the Kyoto Protocol) to cut emissions by 5% between 2008 and 2012 against the 1990 baseline year. As part of the distribution of the emissions target, each country assumed a different percentage, with 8% being the target established for the European Union.

The Kyoto Protocol likewise established a series of instruments called Flexible Mechanisms, whose purpose was to make the achieving of the emissions targets more flexible. These instruments consist of the Clean Development Mechanisms (CDM), Joint Implementation (JI) and Emissions Trading. The European Union decided to set up the emissions trading scheme (EU ETS) with the aim of cutting the emissions of the most CO2 intensive installations.

- Operating

- Sectors and greenhouse gases affected by the EU emission trading scheme

- Emissions trends by sectors

- Installations excluded from the emissions trading system

- Emissions trading verifiers

- Companies of the Basque Country in the EU ETS schema

The aim of the EU ETS is to reduce emissions in a cost-effective way and it therefore uses the cap and trade mechanism, which sets a maximum (cap) on the emissions permitted in the economy and allows the members of the scheme to trade them. With this idea in mind, Europe set up the EU ETS in 2005. The European scheme is based on four fundamental aspects:

- It sets the authorised cap of emissions so that the total emissions fall.

- It defines the economic activities coming under the scheme, requires them to take part in it and allocates them tradable emissions allowances (each “allowance) authorises the holder to emit a ton of CO2 or equivalent of other greenhouse gases).

- It introduces a sound compliance framework. The companies that manage the installations (operators) need emission permits (i.e. authorisations to emit CO2). They are fined if they emit without authorisations or emit more than the authorised amount.

- It uses opportunities to cut emissions around the world, by accepting the Clean Development Mechanism (CDM) and Joint implementation (JI).

The EU ETS authorised installations usually receive emission allowances before 28 February of each year. The operators of the installations can develop their own compliance strategies in order to meet their reduction targets. The installations that keep their emissions under their allowances can sell their surpluses at the price determined by supply and demand at the time. Installations that have trouble to keep under their allocated limit can:

- Cut their emissions by investing in more efficient technologies or using energy sources that release less carbon.

- Buy additional allowances and/or CDM/JI credits in the scheme.

- Resort to a combination of both solutions.

This flexibility guarantees the cost-effective reduction of the emissions, as companies will look for the most economically advantageous solution.

The EU ETS system has been implemented in different phases or “trade periods”. Phase 1, between 1 January 2005 and 31 December 2007, was a “learning by doing" pilot period. During this phase, the infrastructure was put in place needed to control, record and verify the real emissions of the companies involved and a model was introduce to learn from the mistakes and successes. The verification of the annual emissions data filled an important information gap, providing a solid basis for setting the caps for the following phase.

Phase II, between 1 January 2008 and 31 December 2012, coincided with the “first commitment period” of the Kyoto Protocol. A five-year period during which the EU and its Member States had to comply with the emission targets defined in the Protocol.

Phase III, between 1 January 2013 and 31 December 2020, has brought significant changes. It has brought new sectors and new gases into the scheme and there will only be free allocation to the sectors exposed to the so-called "carbon leakage". The allocation will be performed according to “benchmarks” and not to past allocations. Allowance auctions are being gradually introduced to the detriment of free allocations.

Phase III began on 1 January 2013 and started by introducing significant changes to the scheme. One of them is to increase the sectors and gases that come under the EU ETS. Those sectors and gases affected by the entry of the new period are as follows [1]:

SECTORS | GASES |

Power generation | CO2 |

Oil refinery | CO2 |

Iron and steel | CO2 and perflurocarbons [2] |

Glass | CO2 |

Lime | CO2 |

Cement | CO2 |

Pulp, paper and cardboard | CO2 |

Tiles and bricks | CO2 |

Petrochemical, ammoniac and aluminium | CO2 |

Production of nitric, adipic and glyoxlic acids | CO2 and NOx |

[1] The detail list of sectors affect is included in Annex I of Directive 2009/29/EC of the European Parliament and of the Council amending Directive 2003/87/EC so as to improve and extend the greenhouse gas emission allowance trading scheme of the Community..

[2] Only for primary aluminium production..

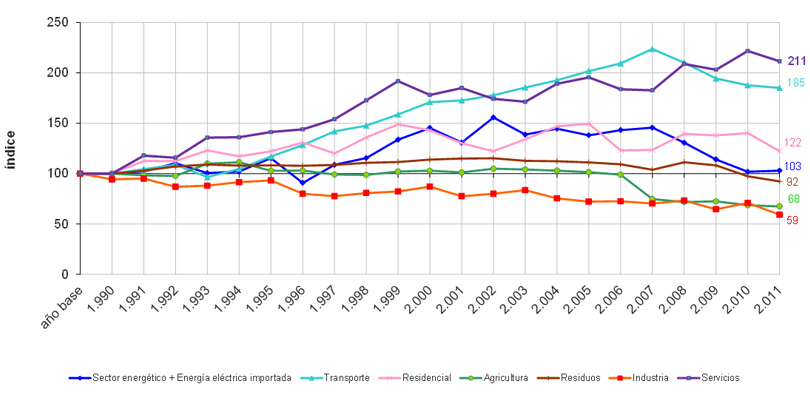

Sectoral trends of the emissions indexed to the base year

Industry and farming, along with the waste sector, are the sectors that have reduced their emissions since 1990.

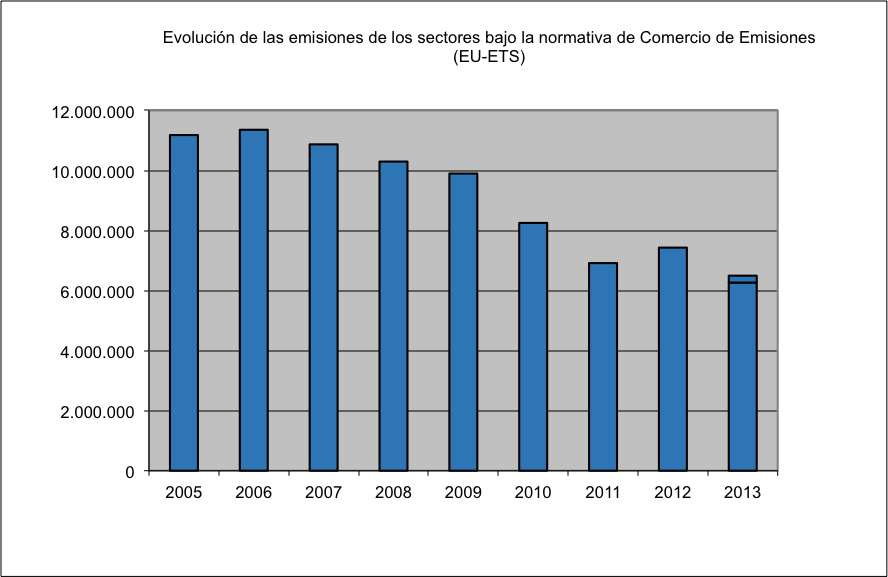

The emissions of companies under the Emissions Trading Scheme regulations (EU-ETS) have been cut by around 40% since 2005. It should be noted that the scope of the legislation was amended between 2006 and 2013 and new installations were added, even though their impact on emissions has been low.

Since the Emissions Trading Scheme legislation came into force, the sectors that have most cut their emissions have been industry (by 33%) and electricity generation (by 76%).

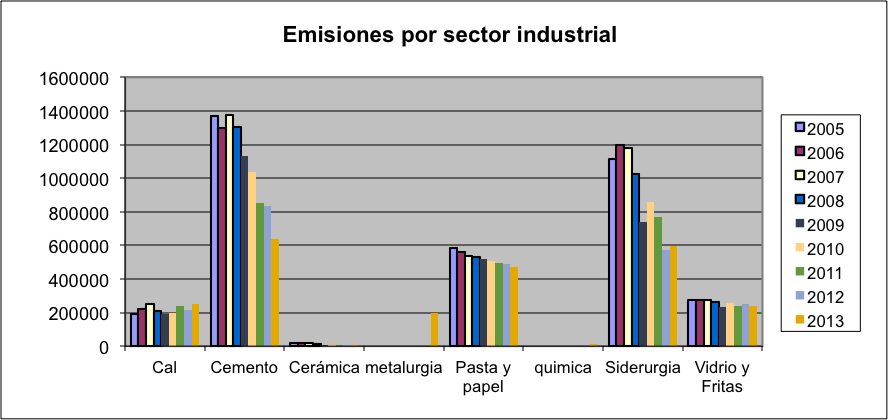

Within industry, nearly all sectors have cut their emissions to varying degrees. In 2013, due to European legislative change, new metallurgy and chemical installations were added to the Emissions Trading Scheme.

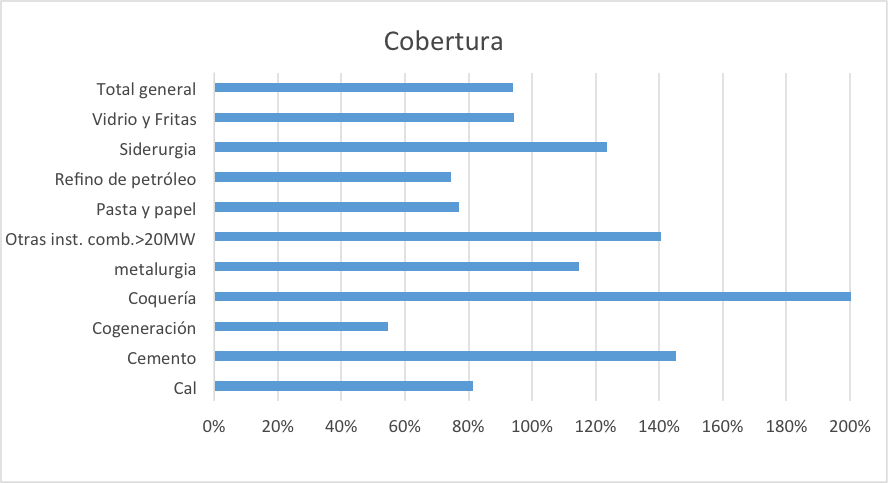

The graph shows the coverage, in other words, the difference between the free allocated emission allowances and the emissions produced at each installation. It should be noted that, pursuant to Decision 2011/278/EU, the free allocation in 2013 was calculated using the capacity set for each installation, the CO2 benchmark set per heat or product unit, and the variations in capacity or production that occurred in each installation in 2012.

In 2013, differences occurred between the free allocation levels (allowances surrendered) and the emissions produced. Special mention should be made of the case of the coking plant, as its emissions were much lower than the allocated level due to the stop of production.

The electricity generation sector is not shown on the graph as its allocation for 2013-2020 is zero.

Additional Provision Four of Act 1/2005 amended by Act 13/2010 allows for the exclusion of small installations. These are hospitals, installations that have reports emissions under 25,000 tons a year (excluding biomass) in the previous period (2008-2012), and combustion facilities with thermal power of under 35 MW, provided that they have requested the 22-month exclusion prior to the emissions trading period (March 2011 for the 2012-2020 period) and have produced the relevant supporting documents.

These installations will have to set up a system to monitor and report their emissions equivalent to the one envisaged by Act 1/2005, and a plan to implement mitigation measures that lead to emissions being cut equivalent to the one envisaged for participating in the emissions trading scheme.

Royal Decree 301/2011 specifies the equivalent measures and the monitoring and reporting system for these installations.

If during a calendar year, an installation, except for hospitals, were to issue over 25,000 tons, or the equivalent measures were not applied in any installation, the installation in question would be reintroduced in the scheme and will remain in it throughout the emissions trading period.

Companies excluded in the Basque Country

- Cerámica Marlo SA

- Fagor Electrodomésticos (antes Cofely Energia Arrasate AIE)

- Guipasa, S.A.

- "Kem One Hernani

- (antigua: Arkema Química SA)"

- Kosorkuntza, A.I.E. - Instalación del Hospital de Cruces

- Kosorkuntza, A.I.E. - Instalación del Hospital de Zorroaga

Commission Regulation (EU) No 600/2012 of 21 June 2012 on the verification of greenhouse gas emission reports and tonne-kilometre reports and accreditation of verifiers pursuant to Directive 2003/87/EC of the European Parliament and of the Council establishes that (Article 54) “the tasks related to accreditation pursuant to this Regulation shall be carried out by the national accreditation bodies appointed pursuant to Article 4(1) of Regulation (EC) No. 765&2008”.

Furthermore, Article 4 of Regulation (EC) No 765/2008 of the European Parliament and of the Council of 9 July 2008 setting out the requirements for accreditation and marketing surveillance relating to the marketing of products and repealing Regulation (EEC) No. 339/93, establishes that “each Member State shall appoint a single national accreditation body”.

The emissions trading accredited companies are published on the ENAC website (National Accreditation Entity).

Acería de Álava SA

Aceros Inoxidables Olarra SA

Aiala Vidrio SA (antigua Vidrala SA)

Alcoa Transformación de productos, SL (Amorebieta)

Arcelor Mittal España SA - Fábrica de Etxebarri

Arcelor Sestao

Arcelormittal Guipuzcoa SLU - Bergara

Arcelormittal Guipuzcoa SLU - Fábrica de Olaberría

Arcelormittal Guipuzcoa SLU - Zumárraga

Bahía Bizkaia Electricidad-BBE

Bahía de Bizkaia Gas, S.L.

Befesa Zinc Aser SAU

Bizkaia Energia SL-Amorebieta

Bridgestone Hispania, S.A. - Planta de Bilbao

Bunge Ibérica SA - Fábrica de Zierbena

Calera de Alzo SL (Alzo)

Celsa Atlantic - Vitoria

Celulosas Aranguren

Celulosas Moldeadas Hartmann SA

Cementos Lemona SA

Cogeneración Gequisa

Cogeneración, Energías Renovables y Medio Ambiente SLU - CERM SLU (antigua: Inquitex)

Cominter Tisu

Construcciones y Auxiliar de Ferrocarriles SA "CAF"

Ecofibras Aranguren

Enagas Gaviota

Energyworks Vit-Vall

Esnelat, S.L.U.

Gerdau Aceros Especiales Europa, Planta de Azkoitia

Gerdau Aceros Especiales Europa, Planta de Basauri

Gerdau Aceros Especiales Europa, Planta de Vitoria

Guardian Llodio Uno SL

Hidroeléctrica Ibérica (Ciclo Combinado - Grupo 4)

Mercedes-Benz España SA - Fábrica de Vitoria

Michelín España Portugal, S.A. - Lasarte

Michelín España Portugal, S.A. - Vitoria Gasteiz

Moyresa Girasol S.L., Planta Zierbena

Munksjö Paper SA

Nervacero SA

Onduline Materiales de Construcción SA

Papel Aralar SA

Papelera del Oria SA

Papelera Guipuzcoana de Zicuñaga SA

Papresa SA + Cogeneración

Petróleos del Norte SA

Productos Tubulares SAU

Sarriopapel y Celulosa SA (Berrobi -Uranga-)

Smurfit Kappa Nervión SA - Iurreta

Sociedad Financiera y Minera SA (Arrigorriaga)

Sociedad Financiera y Minera SA (Donosti - Añorga)

Tubos Reunidos Industriales SLU

Unilever Foods España, S.A.

Vidriera y Cristalería de Lamiaco S.A. (VICRILA)

Zubialde SA

Last modified date: